Delinquent Accounts

How can I make a payment?

Payments are not accepted by phone. Please refer to our payments page for payment options.

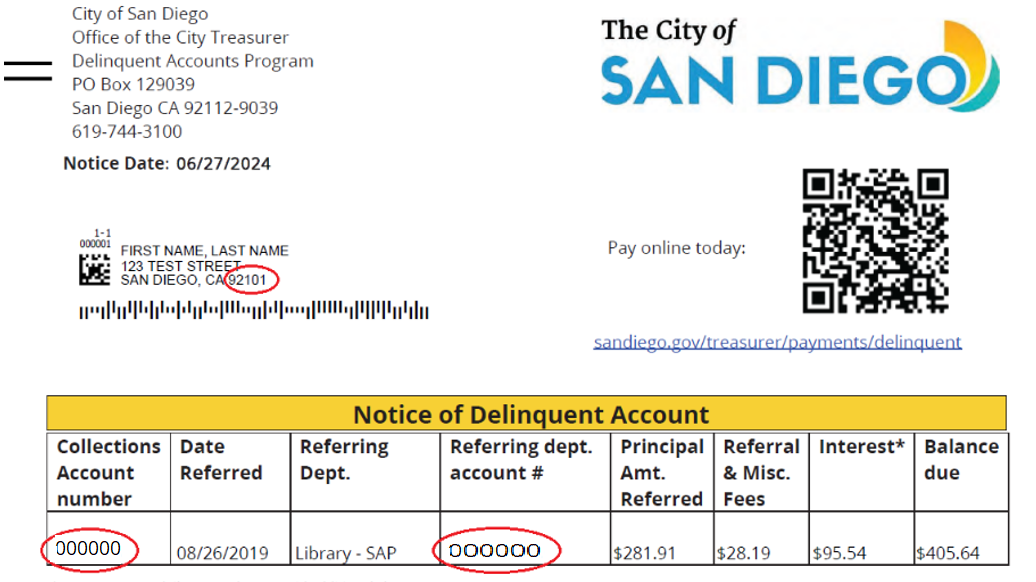

Where can I find my account number or referring dept account number and zip code to make a payment online?

This information can be located on our notice, in the spots circled in red below.

What are the consequences of continued non-payment?

Credit Reporting - Submission of negative credit report of this debt to a credit reporting agency may occur for applicable debts.

- Franchise Tax Board Intercept - Unpaid amounts may be submitted to the California State Franchise Tax Board for applicable debts to intercept tax refund or lottery winnings you may be owed.

- Lien on property - A lien may be placed on your property with the County of San Diego for applicable debts.

- Litigation - You may be taken to Small Claims Court on balances of $6,250.00 or less. Balances above $6,250.00 will be submitted to the City Attorney’s Office to pursue in Superior or Federal Court. All court-awarded costs and attorney fees will be added to your existing debt.

Do you charge interest?

7% annual interest is charged on the principal amount due unless otherwise stipulated by an agreement, contract or Court order.

How do I obtain a copy of lien against my property?

Creditors, including the City, can record various documents with the County Recorder that result in real property liens. A copy of any document recorded against your property can be obtained from the County Recorder , a fee may apply.

Why am I being billed a rental tax for my property if it is not a rental property?

If you received a Rental tax bill, and you live in your property, then you will need to complete a two-step process by submitting a Rental Tax exemption form to the City of San Diego, and file your Homeowners Claim for Property Tax Exemption to the County of San Diego.

For further information on rental taxes please visit https://www.sandiego.gov/treasurer/taxesfees/btax